Standard deduction against. itemizing

You may have a choice annually to the whether to make the standard deduction in your Irs submitting or itemize all of your write-offs. Obviously, you’ll choose the the one that reduces your tax bill even more. not, you can want to duck the effort away from itemizing in the event the benefit you get off doing this was minimal.

- Married people filing jointly: $twenty-five,900

- Solitary taxpayers and you may married some body processing independently: $a dozen,950

- Brains from households: $19,400

Home improvements

You might subtract the interest in your HEL otherwise HELOC payments only toward ratio of this borrowing from the bank that was accustomed get, build or significantly change your family one to secures the mortgage. So, if you put a few of the continues some other one thing, you can not deduct the interest toward those things. They could were debt consolidation reduction, medical expenditures, a cruise, a marriage, or other purchasing one to was not having renovations.

Just what constitutes costs one to drastically change your family? Unfortunately, there isn’t any clear definition. But the majority of recommend this means developments you to definitely include convenient worthy of in order to the home https://paydayloancolorado.net/hartman/.

Thus, repairs, remodelings and enhancements are likely to be considered projects that alter your house. But consult your income tax professional one which just deal with really works one to may well not include good-sized well worth to your house. Which may are setting-up a giant aquarium otherwise a 20-vehicles below ground driveway. Speaking of things that many coming people you’ll value below you are doing otherwise regard as the a responsibility.

Constraints in order to home security mortgage tax deduction quantity

If you’ve made use of your home once the collateral having high borrowing from the bank, you might not manage to subtract the interest on your own whole financial obligation. Quite simply, you’ll find limits to your deductible areas of these home loan and you can household guarantee funds or credit lines. New Internal revenue service explains:

You could potentially deduct home mortgage focus on the basic $750,000 ($375,000 if partnered filing on their own) regarding indebtedness. Yet not, high constraints ($1 million ($500,000 if the married processing separately)) use if you find yourself subtracting financial attention regarding indebtedness sustained just before .

So, if for example the earliest and you will 2nd home loan(s) provides balance over $750,000, you could subtract attract on the only the very first $750,000 of those. One assumes on you may be hitched and you will submitting as one as well as your finance was old immediately following .

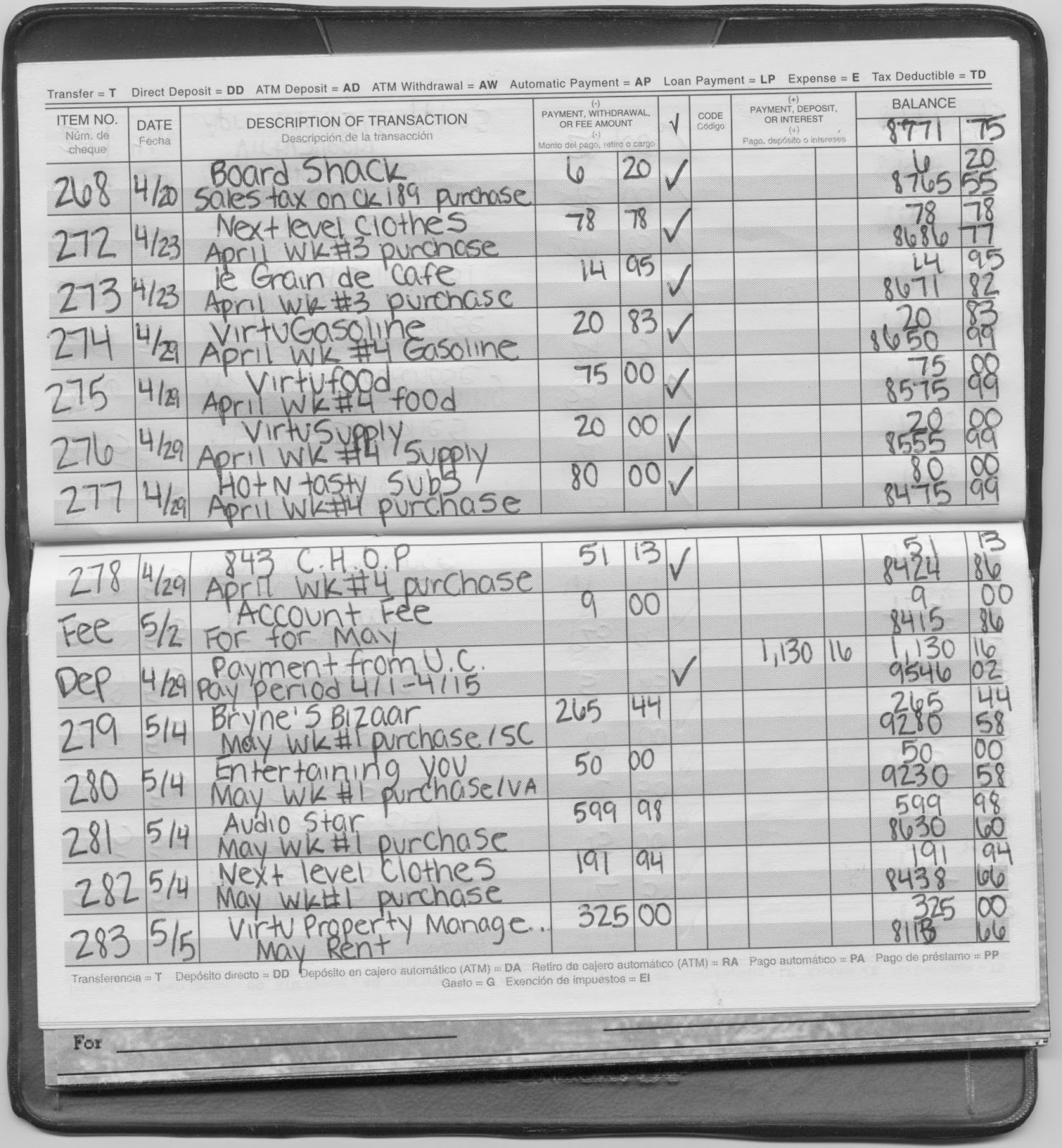

How exactly to subtract family security loan attention

From year to year, you need to located an application 1098 about providers or organizations to which you make repayments on the very first and 2nd financial(s). That it lies aside one to year’s mortgage payments. And it also trips them into appeal and dominating receipts. You could deduct only the appeal payments.

You enter the amounts you’re deducting, because the shown on the 1098 versions, towards the Schedule A part of the proper execution 1040 income tax go back.

Could it possibly be worth using a property guarantee loan whether it isn’t really tax-deductible?

In some cases, family collateral fund and you can HELOCs are usually minimum of pricey kinds of credit around.

Think about the income tax deduction just like the cherry on the cake. It may create a little on appeal of the newest pie (or financing). But it’s probably not just what produced you want they on the beginning.

Do i need to score property collateral financing otherwise a great HELOC?

When you find yourself a homeowner and require so you can borrow a life threatening contribution, a great HEL otherwise HELOC might be a suitable solutions. But which you favor relies upon your circumstances and choices.

HELs try quick installment fund that have repaired interest levels. It is possible to make you to match your funds from the opting for a phrase (the time the loan persists), which means you often has a great amount of quicker costs or less big of these. Because the you’ll end up expenses closing costs long lasting count your borrow, it may be worth it to draw a much bigger share.

HELOCs be a little more tricky and you should review them before you choose one. It operate a little while such as handmade cards while the you may be provided a beneficial borrowing limit and will acquire, pay back and you can use again as much as you to definitely restriction anytime. And you pay month-to-month notice just on the latest equilibrium. They have a tendency to own smaller – often no – closing costs than just HELs however, include varying interest rates.

2nd actions

Like with very kinds of borrowing from the bank, there are a wide range of interest levels, loan charge, and you may can cost you around. Thus, it’s essential shop around for the best possible package. You could rescue thousands of dollars.

Let us assist you with one to. We are able to expose you to loan providers that can offer aggressive dealspare its estimates (while others) and pick your least high priced option.