When you are anything like me, you love checking out the headlines. If perhaps you were watching or training information stores recently, maybe you have seen a statement on U.S. Department off Houses and you will Urban Invention (HUD) reflecting a hobby that will generate homeownership inexpensive and you may accessible to own performing anyone and group.

Into the , HUD quicker the new annual home loan insurance fees (MIP) to own homebuyers obtaining a federal Houses Authority (FHA) loan. The latest avoidance provides the fresh new superior out of 0.85 percent so you’re able to 0.55 percent for many FHA individuals, ultimately bringing full savings and providing more folks qualify for a good mortgage.

This puts more individuals on the way to home ownership, in which they register scores of other people who is delighted, but threatened, because of the home financing process, and particularly by the FHA financing. FHA loans are among the most typical a mortgage selection, but they are aren’t misinterpreted. Understanding the rules about this popular type of financing might help you, the ones you love and your loved ones when going into the market to pick a house.

1. What is actually an enthusiastic FHA mortgage?

Put another way, an FHA mortgage is a loan that is supported, otherwise covered, by the Federal Casing Expert. The new FHA indeed administers several types of finance, but we are going to focus on the old-fashioned mortgage, that’s probably just what one thinks of when you pay attention to FHA financing.

As clear, new FHA will not lend the cash. Locate an enthusiastic FHA financing, you should run an approved bank, such as for instance Financial off Utah.

To provide a short bit of record: Ahead of 1934, we had to save adequate currency to incorporate an excellent fifty percent downpayment on the domestic. Most people decided not to. Congress created the Government Houses Power into the 1934 and you may enacted the newest Federal Casing Work a similar 12 months, which offered and also make homes and you can mortgages much more available and sensible.

Lenders sustain smaller chance which have FHA financing given that, based on HUD, new FHA will pay a state they the lending company into unpaid principal balance out-of a defaulted home loan, in the event the a borrower doesn’t create payments. Once the money try insured, the fresh new credit criteria to possess FHA finance is actually smaller strict than other kind of home loans, getting home ownership close at hand when you have shorter-than-best borrowing from the bank or perhaps not adequate money on hands to possess an enormous down-payment.

- Reduce fee requirements

- All the way down credit scores standards

- Highest restriction financial obligation-to-money ratio conditions (determined from the isolating their total monthly obligations repayments by the gross month-to-month income)

- Reasonable interest levels

- No prepayment charges (definition you might pay off your home loan at any time, fee-free)

step three. Who qualifies getting an FHA loan?

FHA money is attractive to earliest-big date homebuyers, however, surprisingly, the newest FHA have a tendency to guarantee mortgage loans for the primary quarters, be it the first house or not. In order to qualify for a keen FHA loan compliment of Financial regarding Utah, such as, consumers need certainly to:

- Done an application, that have a valid Social Shelter matter, target or other contact details.

- Make sure the financing is utilized to have a first home.

- Render a beneficial proven a career history during the last 2 yrs.

- Be certain that income.

From inside the , the newest FHA offered loan qualifications to people classified just like the which have Deferred Step for Child Arrivals condition, called DACA, or Dreamers. DACA borrowers ought to provide a legitimate Social Safety amount. They need to also provide a legitimate Work Agreement Document provided by You.S. Citizenship and you will Immigration Properties, in addition to match the left criteria in the list above.

cuatro. What exactly are other considerations when searching for the FHA loans?

FHA guidelines become constraints towards the cost of home, based on city, and you will mandatory inspections to make certain residential property see certain defense requirements (that the end could work in your favor and you will conserve you against and come up with comprehensive repairs which could harm your allowance).

The largest believe having FHA financing ‘s the initial and yearly mortgage insurance premiums (MIP), that assist protect loan providers from losings. The latest upfront MIP costs step 1.75 per cent of your FHA loan and certainly will getting financed towards the borrowed funds in itself. The brand new annual MIP percentage may vary dependent on the loan matter and you will identity, and that’s built-up per month within your mortgage percentage.

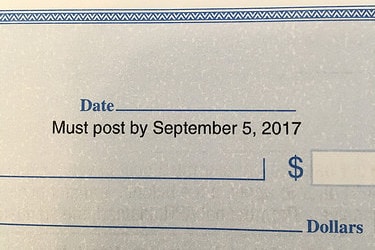

As previously mentioned before, the government are decreasing the annual MIP from 0.85 % so you can 0.55 % for the majority of FHA consumers, active for FHA fund signed into or shortly after ple, individuals to buy an individual home with a beneficial $265,000 home loan is going to save everything $800 in the first seasons of its mortgage. To own a home loan regarding $467,700 – the latest federal average house price since – brand new protection will save you the house client more than $step 1,eight hundred in the 1st year.

Even after brand new reduction in yearly MIP, it part of an enthusiastic FHA financing should be thought about carefully. One to matter to ask yourself is: Can i get a different type of mortgage immediately you to cannot were MIP, or would I only qualify for an enthusiastic FHA financing including MIP? For people who merely be eligible for an enthusiastic FHA financing, you could probably get rid of the home loan insurance percentage down the road by the refinancing to another variety of loan when your credit is ideal or when you yourself have extra cash.

An initial Expertise Can make To invest in property More enjoyable

At some point, FHA financing shall be great devices to own people, plus they makes it possible to reach finally your imagine becoming a good homeowner.

Whenever you are thinking of buying a property, sit-down and you will evaluate the obstacles and you will potential. Carry out lookup. There are a number of apps and you may gives to assist homebuyers. From the Financial of Utah, such, we have entry to our home$tart offer, which can render a small quantity of finance to possess eligible first-big date homebuyers commit to your the purchase out of a house. That grant can be utilized that have FHA money.

Usually make inquiries. Despite the suggestions I have given here, the process can nevertheless be overwhelming. It’s a good idea to inquire of financing administrator ahead than simply be very impressed for the application process. Anyway, to buy property are going to be pleasing, maybe not excessively tiring.

Eric DeFries is the loans Eunola AL Senior Vice-president, Home-based Financing, for Bank regarding Utah. In the first place from Layton, he has experienced the brand new funds globe having sixteen many years and having Bank out of Utah to possess 12 ages. The guy provides into the Panel out-of Commissioners with the Ogden Homes Power. Within his leisure time, Eric enjoys to try out and you may seeing activities, travelling, and you may spending time with his family and friends.