To shop for a home is actually a cornerstone time from inside the every person’s life. The fresh new sheer immensity out of conclusion, the fresh new contentment of obtaining something you normally name the and the protection it will bring tends Florida loans to make getting your home an indispensable feel. But in today’s sector property pricing was acutely high and and make up huge financials are going to be a challenging experience. Out-of looking for the finest location to protecting financial support, of numerous swinging pieces flow the home-to purchase cogwheels. However with best pointers and you can help, purchasing a house should be a flaccid and you can easy procedure. That’s where we can be found in: among India’s leading banking institutions ICICI Financial also provides multiple House Loan choices to help people make correct ilies.

Typical Lenders: We offer these types of Lenders to prospects for purchasing another household or even for the building regarding a different house

On ICICI Financial i have designed all our Home loan choices to make it simple for users to buy otherwise make its dream home with aggressive rates and flexible payment selection. Our activities and additionally appeal to vibrant buyers demands. Whether you’re a primary-go out homebuyer or seeking to change your current home ICICI Lender enjoys Mortgage possibilities that can do the job.

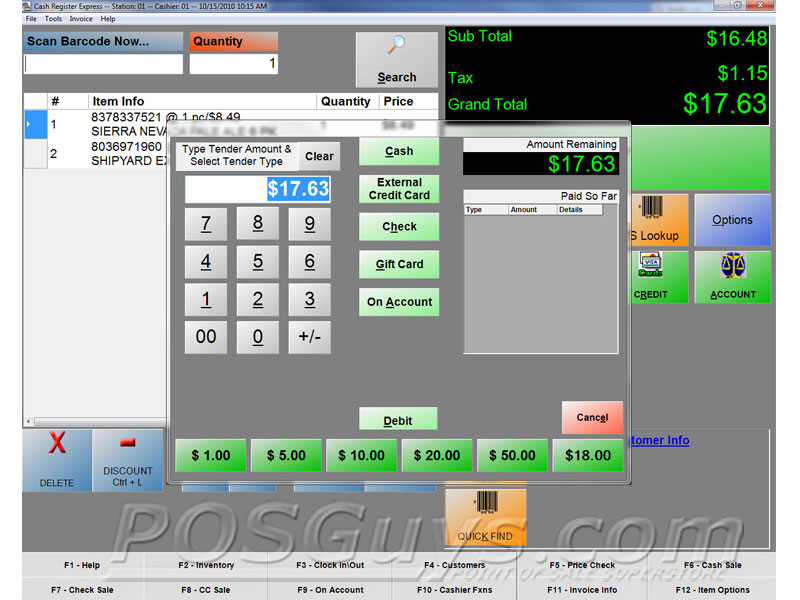

The Mortgage process with ICICI Bank is as straightforward as it gets. Once you get clarity on your eligibility, use the Home loan calculator and get an estimate of the monthly EMI payments you’ll have to make over the repayment tenure. The Home Loan calculator takes into account the loan amount, interest rate and loan tenure to give you an accurate estimate.

After that you may go to make an application for the loan online by the completing the program and you may providing the called for data. ICICI Bank’s advanced level application procedure also let’s undergo the application at a fast rate and you may get your loan amount inside near to virtually no time, once recognition is gotten.

Our house Loan calculator is a superb product that will help you create an informed choice regarding your Home loan requirements and available solutions. You will be able locate an offer of monthly EMI money which can help you determine the brand new value of one’s financing. Brand new calculator plus enables you to examine different mortgage alternatives and buy the the one that is best suited for your circumstances.

At ICICI Bank you can expect a range of Home loan issues to suit some other buyers means. Below are a few of the property Financing selection you can look at:

1. The eye pricing for those finance hinges on the loan number and you can tenure and you may people can also be get to 75% of the home worth as the financing. It is possible to submit an application for a home loan here on our website. You might also visit the nearest ICICI Bank Department add the job.

2. Top-Right up Money: Such finance are given to consumers which currently have an existing Financial which have ICICI Financial and require certain even more money having family repair or extension. All the possessions opportunity for the Asia whether it’s to buy or remodeling has actually the potential for overshooting the first funds. Dropping small does not end you after you mate with united states. This type of money can also be found at the competitive rates of interest and can feel availed instead extra records.

You could begin procedures because of the checking its qualification into the ICICI Lender Financial webpage

step 3. Help Home loans – ICICI Bank Step-in Home loans try entirely geared to the newest young salaried Indian. With this particular financing you could avail of increased amount borrowed than you could potentially in terms of the loan qualification for regular Home loans. Furthermore regarding very first decades you only need to pay moderate EMI quantity to help relieve brand new monetary filter systems.

4. Property Money: When you are just looking to find particular land due to the fact another financing you can buy a land Mortgage of you in the same focus since the normal Lenders. The borrowed funds amount and eligibility requirements will be different.

It’s also possible to here are some our house Overdraft: a single solution to all your resource criteria. These multipurpose much time-period solutions will help you to carry out each other structured and you will unplanned expenses. In case you are seeking mortgage cost expensive, we have a mortgage Harmony Transfer studio that lets your transfer your outstanding loan to a different lender that will bring you greatest cost. If you find yourself already settling a loan that’s hefty on the pocket it’s possible to have the the matter relocated to all of us during the a good repo speed-dependent competitive interest. This is available to anybody who wants to remove their debt weight.