Enhance an initial residence fixer-higher which have good 203K renovation loan

- Log in

- Spend My personal Mortgage

- Get property

- Mortgage Versions

- Re-finance

- Mortgage Calculator

- Jobs

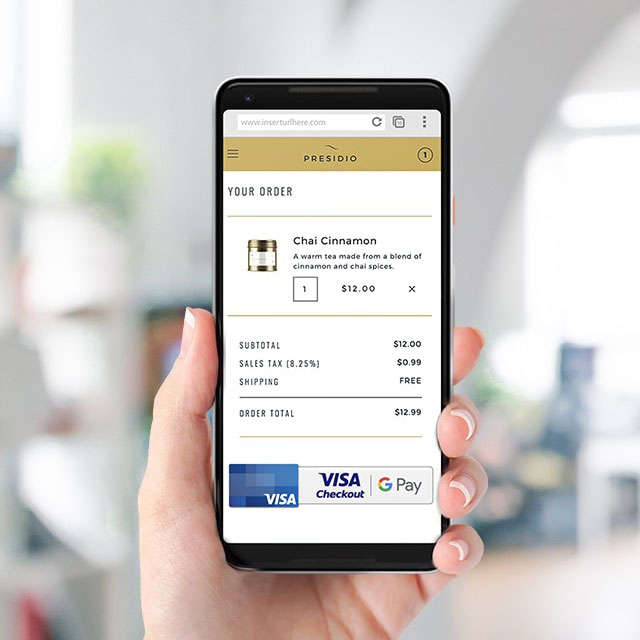

Mann Mortgage is pleased to declare our very own “Fantasies with Beams” system, which gives individuals a much better option for res. When you incorporate a great MannMade Restoration Financing, you can easily get access to our collective, cloud-created repair financing application to manage the entire project from initiate to finish when you’re simplifying correspondence ranging from your, the new builder, 3rd-cluster inspectors, and label people. I control your mortgage while the creator matchmaking into the-home, and you might run a dedicated membership director in the restoration process.

Exactly what are restoration money?

A property recovery loan is a kind of home loan built to financing both a buy or recovery regarding an effective fixer-upper household. Unlike conventional mortgage loans, the newest recovery loan’s interest rate is founded on the value of your house once renovation is finished. This allows property owners to utilize their coming security locate a minimal interest rate you’ll be able to. Restoration money can also be used to help you re-finance and you will upgrade a beneficial household brand new borrower currently is the owner of.

Restoration Fund Short Consider

- As much as 100% money to possess USDA and you can Va

- Loans up to 100% regarding domestic value after work is finished for (USDA and you will Va finance)

The Customized Renovation Mortgage Speed

203K funds was protected by Federal Construction Administration (FHA) and are tend to employed by family members in lower- to help you modest-money mounts to find otherwise refinance an initial household in need of resolve. (더 보기…)