The latest fifty-year home loan basic appeared in southern California, where property is getting increasingly expensive, and individuals were hoping to find the fresh new an easy way to remove its month-to-month home loan repayments. Apart from the excess two e since a 30-12 months fixed financial.

The main benefit of a great 50-year mortgage is the down percentage, although significantly high much time-term can cost you will get outweigh that it advantage. Let’s see if you really need to go lower you to definitely much time street.

What’s the point regarding a great fifty-season financial?

Some fifty-12 months mortgage loans has repaired prices. They are designed to be paid away from that have consistent repayments more than 50 years. Adjustable-speed mortgages (ARM) which have an expression out of 50 years can also be found. An arm has a fixed price to own a-flat several months, and is adjusted regularly for the rest of the borrowed funds title.

The preferred cause someone take out good fifty-12 months financial is to down their monthly installments. The idea is always to give the loan over longer being spend quicker per month than you would which have a smaller-title financing.

The payment per month could well be large if you are using an effective fifteen otherwise 31-12 months mortgage. Monthly premiums tends to be somewhat less of the stretching the mortgage. A 50-season mortgage lowers the monthly payments, which enables you to definitely acquire extra money and buy a more impressive household than simply you can afford.

Fifty-year financing which have a primary period of merely paying rates of interest will get also have alot more self-reliance at the beginning of the loan label. That is of good use for many who manage brand new higher will cost you of getting into, furnishing, or fixing another type of domestic.

Drawbacks out-of 50-year mortgages

You should buy home financing so long as 50 years in the usa, however these are not qualified mortgage loans. Only a few lenders are curious about non-accredited mortgages, which means your solutions might be restricted. But this is not perhaps the first otherwise next greatest drawback out-of 50-seasons mortgages.

First, the total amount of focus paid off at the end of the fresh new identity is much more in the case of good 50-seasons home loan. That it comes from the latest prolonged mortgage term and the large attract speed joint. All of this causes 50-seasons mortgages which have a very high total price as compared to a beneficial 15 otherwise 31-12 months home loan.

Furthermore, since the mortgage identity is indeed long, you are able to gather equity at a much slower speed which have an effective fifty-season mortgage. This may result in a lengthier-than-common wait go out when you need to re-finance, score a property collateral mortgage, otherwise remove private financial insurance (PMI), which require that you meet minimum security thresholds.

50 years in financial trouble are lengthy. Even if you get a home when you are 25, you will only be able to pay it off once you are 75. It takes your a 1 / 2-century to own our home, and you can additionally be repaying interest in addition dominating matter during this time.

Selection of getting a 50-season mortgage

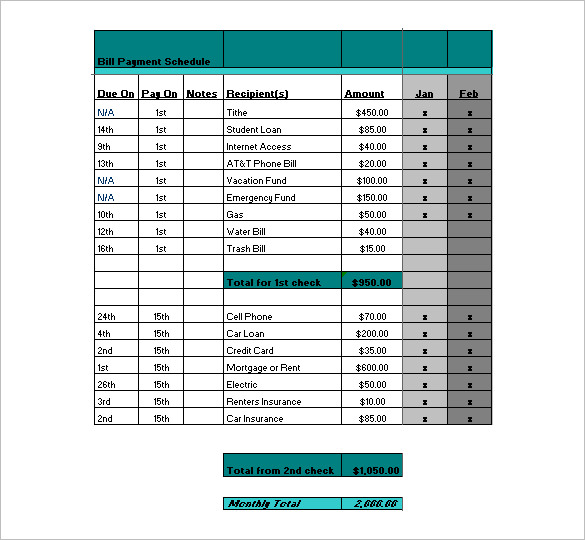

Budgeting is among the most efficient way to increase your own investing stamina to the things that its matter. Make a monthly budget and you can eliminate a few luxuries to allow to own a thirty-12 months otherwise a beneficial 15-12 months financial. Utilising the budget truthfully will make sure might end being required to get into personal debt for the next half a century.

An urgent situation money is additionally requisite whilst will cover your own expenses when you look at the surprise economic crisis. Save yourself adequate currency in order to past at least a couple of months in case there are business losses or injury one suppress you from working. A crisis loans will also help your steer clear of personal debt by providing profit days of you prefer rather than counting on the charge card or a consumer loan.

Managing your debt will also help you keep your own monthly expenses reasonable, letting you pay for a faster and less costly (altogether) mortgage. If you have several vulnerable bills, consider merging the money you owe on one, even more in balance payment. Discussing all debts will give you area in your cover a more quickly and you will total less financial.

- Protecting having a more impressive advance payment.

- Playing with a changeable-rate mortgage.

- An attraction-merely financial.

- To invest in a cheaper family.

The conclusion

Fifty-seasons mortgage loans are not the fresh otherwise groundbreaking, and there is a description as to the reasons they are not common. Although they are a good idea for many people thinking of buying property in the a pricey housing marketplace, for many people, it is preferable avoided.

The lower repayments out of an excellent fifty-year financial don’t outweigh its drawbacks. To possess a home, you don’t need to go into loans for the next 50 decades. There are lots of an effective way to take your established financial situation so you can an area where you can effortlessly pay for a vintage 15 otherwise 30-season financial.

Regarding the Blogger: Lyle Solomon provides thorough legal sense, in-breadth education, and you can experience with consumer loans and creating. He’s started a person in brand new Ca Condition Club once the 2003. The guy graduated in the University of the Pacific’s McGeorge College off Law in the Sacramento, California, inside the 1998 and you will already works well with the fresh Pine Glance at Legislation Class into the Ca because a main lawyer.