For folks who individual accommodations assets, you already know its an effective way to obtain passive money. But may you utilize they to create better riches through getting property equity loan towards accommodations property? Experiencing new guarantee regarding a low-number one house is an integral part of debt method. Into the best situation and recommendations, you can use an educated family collateral financing to guard the financial support otherwise increase your payouts.

Are you willing to rating a home collateral loan to your a rental possessions?

You can purchase a home security loan into accommodations assets for many who see what’s needed, particularly with sufficient equity on the possessions and you will a great credit history. Tapping into the collateral of your own investment property will be region out of a wider financial support and you will riches-building techniques.

However, you will need to perform the computations to find out if a property security loan in your local rental home is how to supply most finance. You need to be able to repay the mortgage and have a concrete policy for using the sum you found. Since the we’re going to select after that to your, just because you should buy a home collateral mortgage into the a good local rental property cannot immediately suggest you will want to.

You should make sure before you apply to have a rental assets house guarantee financing

Just before committing to a house equity mortgage on your leasing property, make sure to comprehend the individual situations and you will ramifications which go toward borrowing from the bank. You ought to ensure that you are in the right position to manage inherent costs. Think about the pursuing the:

The money you owe

Your financial situation will influence even in the event you can purchase acknowledged and you may though you can afford to settle your rental assets house collateral loan. Lenders usually look at the money and you may credit file. Really lenders want a rating with a minimum of 700.

Your debt-to-income (DTI) proportion also can affect your capability so you’re able to acquire. Which DTI really worth suggests the level of loans you really have compared on the money. Loan providers have a tendency to want to see an excellent DTI off 43% or less, as this suggests room enough on the budget to look at another type of commission.

To settle your house guarantee mortgage, you really must be willing to generate monthly obligations promptly when you look at the addition toward financial. Family collateral finance come with settlement costs. You truly must be equipped to handle these additional costs over the top of your the latest payment.

The loan count that you need to have

The value of our home and the security you have set up tend to directly determine the new money number of the borrowed funds you could discover. You might deal with a portion limit towards the total withdrawable equity, instance 85%, if you have paid back the house from completely already.

The borrowed funds-to-well worth (LTV) ratio is also an important style. Their LTV is the review of your own expected amount borrowed so you’re able to brand new property’s appraised well worth. Specific loan providers possess limited LTV hats to have capital services, like 60%.

On top of that, certain banking institutions ount designed for local rental services, such as an excellent $100,000 total. Such ount given to have old-fashioned family equity money, which is numerous hundred or so thousand. Guarantee with your bank whatever they can offer to own non-first residences before applying.

Mortgage conditions and terms

Money spent house collateral financing generally become at the a predetermined rates. They can be provided having regards to 5 to help you three decades in total. You happen to be capable of getting that loan and no pre-percentage penalty. However, the interest rate is generally high into the a home guarantee loan to have a rental possessions.

Tax effects away from local rental possessions domestic collateral loans

The interest you only pay on your local rental property household security loan is tax-deductible, which can only help lower your taxable income. But not, so you can qualify for this income tax deduction you ought to utilize the mortgage to change the house. Simultaneously, you simply cannot rent the house or property during that income tax season, and you also need certainly to designate the house or property due to the fact a professional quarters on your tax get back.

Solution money offer readily available

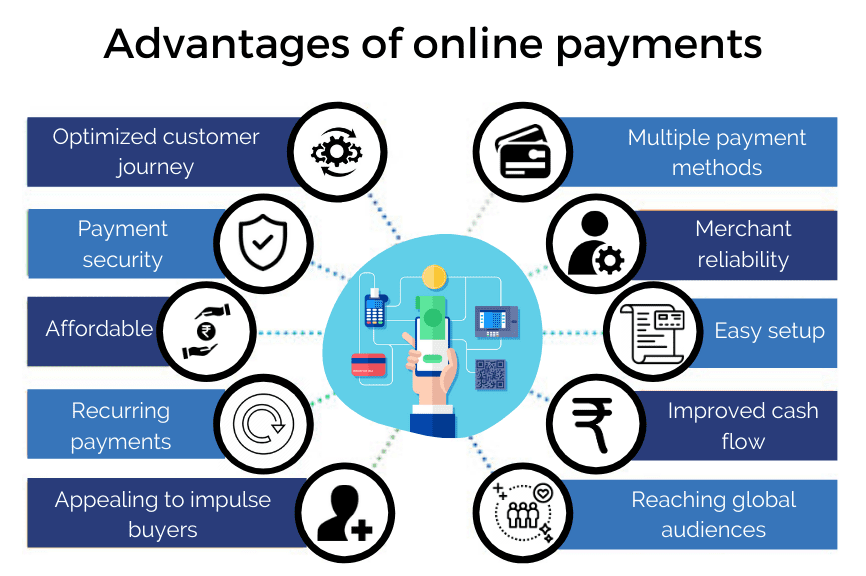

If you are searching having choice financing present towards the domestic collateral loan, you could desire to examine these other choices:

- House security line of credit (HELOC): Another alternative to utilize your home security is a property security line of credit. While you are a home equity financing offers a lump sum payment lent up against your own collateral, a great HELOC is a personal line of credit you may also charges facing doing their restrict as required. Then you certainly pay it off, just like exactly how credit cards really works.

- Cash-aside re-finance: A funds-out re-finance makes you take back a number of the currency you paid off to the a home loan following refinance the greater number at this point you owe. It a simpler processes than just a property guarantee loan as it concerns one commission, while a home security financing need that build typical financing costs at the top of mortgage payments.

- Unsecured loan: Though rates of interest toward personal debt such as for example an unsecured loan are usually higher than cost into protected financial obligation such as a great domestic equity mortgage, they’re better in the event you don’t need to lay their money spent vulnerable to potential foreclosures.