An introduction to Family Depot Finance

Our home Depot Company has the benefit of lucrative financing choices to the people. Consumers to find tools, gadgets, and do-it-yourself circumstances can use investment selection provided by Home Depot.

Its a convenient opportinity for users because they do not have to sign up for third-cluster financial support. Family Depot also provides money and their leading consumer and you can opportunity credit notes with different loan terms and conditions.

The borrowed funds application processes is simple and consumers can use on the internet or by visiting a store. The application approval standards, rates, or other conditions are different into various things (discussed less than).

Household Depot Credit card

Citi bank. But not, in place of other handmade cards, they can just be used in shopping within House Depot areas and you may online sites.

So it bank card has the benefit of 0% rates in the event that people pay off a complete amount within 6 months. Although not, you are going to need to shell out accumulated notice when you yourself have people left balance after the promotional months.

- 0% notice when the repaid inside 6 months of marketing period on the purchases out-of $299 or more.

- Changeable Apr having fundamental cost terms regarding -%.

- Later Payment payment regarding $forty.

- To twenty four-days out-of installment words according to credit matter.

- No annual costs.

Home Depot Venture Loan Charge card

Your house Depot opportunity mortgage is actually for customers shopping for bigger home improvements. That it mortgage is perfectly up to $55,000 for your home recovery and you will upgrade costs.

The project financing mastercard can also be used here at the home Depot stores to possess searching. Consumers has around half a year to totally use the recognized loan amount.

- Comes with a credit limit have a peek at this web site regarding $55,one hundred thousand

- Zero yearly fee

- Financing regards to 66-, 78-, 90-, and you will 114-months

- Fixed APRs regarding eight.42%, %, %, and you can % respectively for words in the above list.

Family Depot Bank card Application Techniques

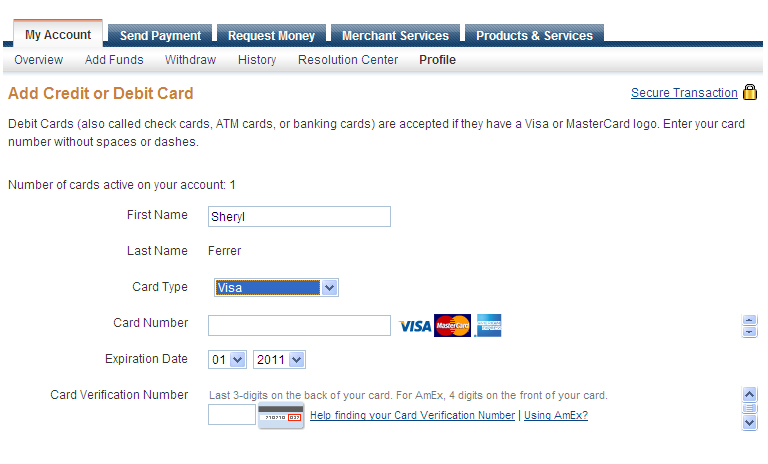

Consumers can apply on the web or on House Depot stores getting their popular mastercard. The house Depot borrowing from the bank heart ratings software and you can protects the borrowed funds procedure.

There’s no prequalification phase during the House Depot funding services. It means there’ll be a painful credit inquiry when you sign up for credit cards the home Depot.

The genuine standards and approval process will depend on of several situations together with your money, borrowing from the bank reputation, and you will earlier in the day history.

Home Depot Mortgage Denied 5 Reasons You have to know

Even if you finished the information and you can files standards, there isn’t any make certain your home Depot venture loan usually end up being approved.

Poor credit Rating

Your house Depot and its particular investment partner will evaluate the borrowing from the bank score like any almost every other lender. There is absolutely no reference to minimal credit rating requisite officially even when.

But not, in case the credit history was crappy, it is likely that the loan application might be declined. In case your almost every other investigations metrics try important, then you’ll definitely you need a higher still credit score to progress having an application.

Warning flag on the Credit history

Loan providers glance at your credit history to assess the history. He or she is always keener to learn the way you reduced your own prior finance.

Should your credit rating reveals later monthly payments, put off money, default, otherwise bankruptcies, your chances of loan acceptance are slim.

The debt-to-Income was Highest

The debt-to-earnings ratio reveals simply how much of the gross income is certian to your month-to-month loan payments. It means if this ratio are higher, you have got a tiny cushion so you’re able to serve an alternate financing. Like most most other financial, House Depot will also be curious observe a lesser financial obligation-to-money ratio on the credit character.

A major reason for people mortgage rejection is that your revenue resources is volatile. It indicates you do not have a guaranteed or permanent money provider.

It sounds as well obvious you might have offered the fresh new completely wrong information regarding the loan software which will result in a rejection.

Such as, it’s also possible to go into the information on an excellent cosigner and you will go wrong. Similarly, one omission or errors on your applications can result in financing rejection too.

How exactly to Replace your Recognition Chance at home Depot?

You could potentially re-apply within Family Depot having a special enterprise loan or a credit rating card any moment. But not, it will connect with your credit rating since it incurs a painful eliminate and you will minimizes your credit score.

Alternatives in order to House Depot Endeavor Mortgage

Reapplying during the Household Depot to have a job loan could cost your credit score items. You can consider a few choice toward credit credit and the investment financing.

Think any other do-it-yourself financing given by a commercial lender, borrowing from the bank union, otherwise private lender. Specific loan providers take on loan applications with various approval criteria.

You might get an even more old-fashioned approach to fund your property advancements through the use of to have property line of credit otherwise range off guarantee dependent on your needs.

When you have created domestic guarantee, it can be utilized due to the fact a promise in order to secure an individual loan. You need so it recognized consumer loan when it comes down to objective in addition to your property update conditions.

In the end, if your current financials do not allow having an alternate loan, you could re-finance one of the existing financing. You might re-finance a personal bank loan, a mortgage, if not bank card loans to make a pillow for the home improvement orders.