Purchasing another house is no less than an aspiration already been correct for most. Maybe you have heard tales of individuals who protected money penny by penny all their lifetime to own goal of to get property. In the current condition, the newest COVID-19 pandemic made more people read the necessity of its very own land.

Heading your house loan path to buying your fantasy home is a pretty wise solution, given that rescuing for the entire cost of our home may take longer. And you can home financing gives you a chance to meet your dream instead diminishing to your most other requires.

Very, for those who have a record of a suitable family of one’s choices, recall this type of five crucial things if you are applying for an effective home loan:

Dont Fill in Loan applications Having Numerous Financial institutions In addition

Mr. Mehra has been staying in a rented house or apartment with their relatives going back a decade. He has achieved a stable jobs in the community and need to invest in a house he may call his personal. For this, he went to Bank A great, removed home financing, and you may filed the requisite files. Immediately following experience a delay during the acquiring the fresh questioned effect in the bank’s front, the guy recorded another type of loan application so you can Financial B and you may couldn’t tune in to back in time. Their passion made your perform the exact same with Financial C, however, there is zero favorable response.

Many individuals make this error, being unsure of the latest feeling of such frequent attacks to their borrowing rating because of the loan providers. As soon as you complete a mortgage app, the bank checks their CIBIL rating to learn the creditworthiness. Regular requests off numerous banking companies damage your credit score.

While the a home loan applicant, the worst thing you want to happen ‘s the rejection of your app, followed closely by a dip on your own credit score. Which, youre told not to ever complete multiple software with various banks all at once or inside a brief period.

A better way to be certain your property loan application will get recognized should be to search on the internet and look at the creditworthiness. Once you know simply how much amount borrowed you will get, you might submit the program to a financial correctly.

Seek Mortgage Control Or other Fees

not, this isn’t the only real style of charge on the a mortgage. Once the a borrower, you need to know about processing charges, foreclosure charge, or later fee penalties. Just like the overall operating fees cover anything from 0.5% 2% may well not look like a great deal but if you consider the actual count, its a considerable sum of money. Including, by firmly taking a home loan out-of Rs. fifty lakhs, next 0.5% of Rs. fifty lakhs are Rs.25,000.

In many cases, your ount instance GST and you may documentation charge. Together with, certain insurance vendors attempt to get Prattville loans across-sell some insurance and the loan, and this subsequent advances the total price of going home financing.

Most of these costs can truly add doing boost the complete number repayable towards the lender. Which, you need to know throughout the most of these charge such running fees, attorney fees initial to locate ideal understanding for the financial offers.

Including, its imperative that you types and maybe discuss the fees at the outset together with your financial in advance of recognizing a property financing promote. This can be done by keeping a better attention toward details considering on your loan document.

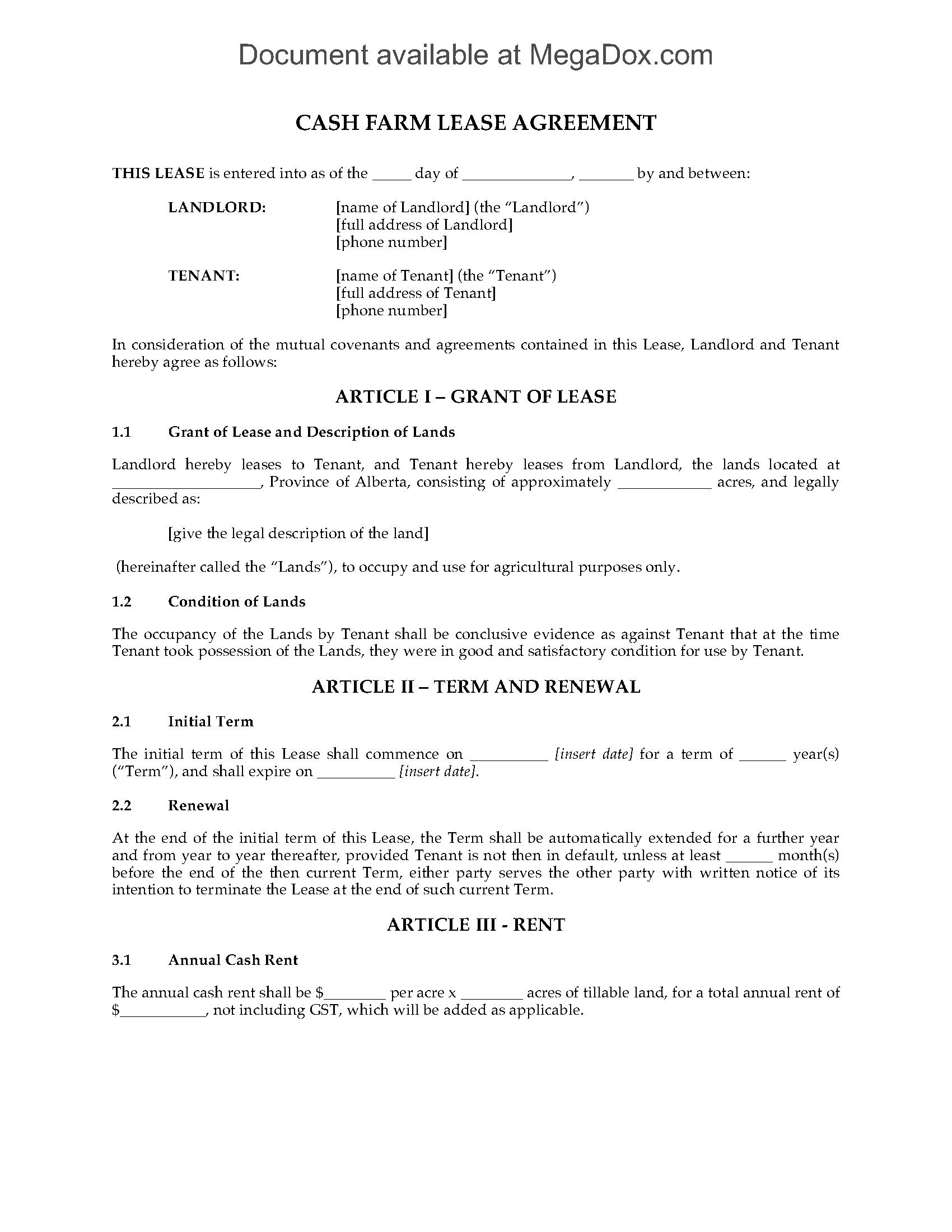

Contrast Home loan Also provides Out-of Various Loan providers

.png)

Comparing home loan also offers away from a few additional lenders seems like a difficult activity. The lending company which offers a loan in the a lesser interest could possibly get require large running charges or any other associated fees. This is how you really need to search better and you will carry out the perseverance of finding the most suitable financial render.

Start the home mortgage testing process by evaluating the eye rates and also the corresponding EMIs payable for the selected tenure. Consider this to be example

Mr. Shah is looking for home financing value Rs. 25,00,000. He would like to pay the mortgage in the next fifteen years and you may inspections the latest EMIs payable to different financial institutions predicated on other rates. Listed below are some of their findings:

With regards to control fees, he pointed out that Financial C costs relatively highest running charges than another two banks. This makes the loan promote from Lender B much better than the fresh most other a couple.

Such as for example Mr. Shah, you’ll be able to create a comparison dining table to own monthly EMIs from individuals lenders playing with on line home loan calculators.

Look at the Small print

Maybe you have see activities in which you keeps experienced monetary losings because of finalizing records quickly without knowing what’s inside? It can be totally avoided. All of the reputable home loan organization, and additionally banking institutions and NBFCs, go after a clear way to approve the loan amount.

As in any circumstances, its a beneficial behavior to learn the house loan application cautiously before signing them within the a madness to save big date. Including, on the learning the fresh new bodily application, it is possible to look for documentation charges which can be recharged twice of the mistake. When it seems undecided and way too many, you can ask the bank managers having explanation before you can bring good wade ahead’ into mortgage render.

Also, you could ask for understanding into in depth EMI agenda considering for the entire tenure you’ve selected to settle the quantity. If you should be questioned so you can signal one too many records, youre informed to inquire of to possess help from a fellow otherwise top-notch.

Understand that careful consideration of financial also offers often not simply save yourself currency and leave you an intensive knowledge of how exactly to do it right.

Choosing Between Bank And you will NBFC Getting Financial

As well as banks, Non- Banking Economic Enterprises (NBFCs) also offer mortgage brokers. Banking companies generally have strict qualifications standards, and running/disbursal of financing usually takes more than asked. Concurrently, it will be simpler to get a mortgage of an enthusiastic NBFC, however should also glance at the rate of interest.

NBFCs generally fees a top interest than banks. Since mortgage cost may go so long as 30 age, also a slight difference between the rate implies a sizeable total getting paid besides the principal.

Going for a mortgage to buy your dream domestic does require homework at your avoid. Right here, you will find listed down five essential items that you need to keep in mind and learn before applying having home financing. Prefer a home loan render that best suits your circumstances because better as your monetary better-are.